Now for the bull market…

The bullion bank establishment is adjusting to gold and silver going far higher, which is why they are deleveraging their balance sheets. It is a process in its early stages.

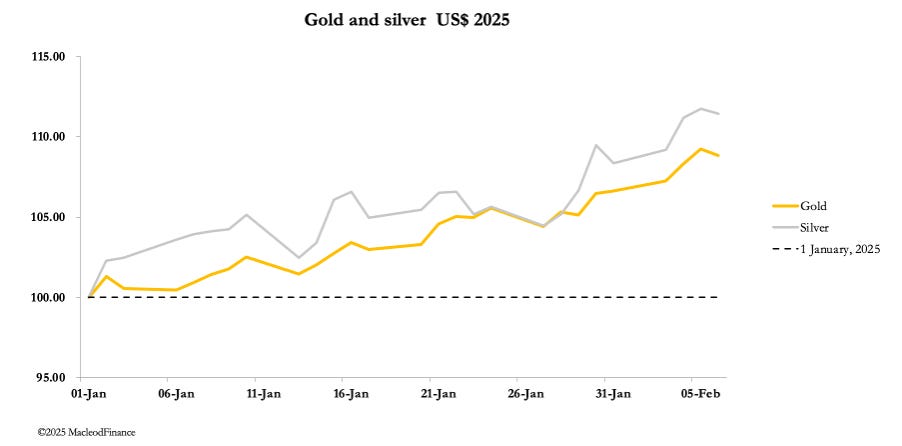

In a wild week, gold hit new highs before correcting modestly yesterday (Thursday). In European trading this morning it was $2865, up $68 from last Friday’s close. Comex’s active contract was at a 3% premium annualised over spot. Silver was $32.26, up 90 cents on the same timescale. Its active contract was trading at an annualised 5.7% premium over spot. Comex turnover in gold was subdued, while in silver it was healthy.

Unusually, as gold was hitting new highs Comex Open Interest declined since 24 January, when in these bullish conditions one would expect it to increase. This can only be because shorts are being squeezed. Stand-for-deliveries continued apace, with 50,465 gold contracts (157 tonnes) in the last five trading sessions, and 2,747 silver contracts (427 tonnes) recorded.

These are remarkable, market-busting numbers.