Massive Comex deliveries since Thanksgiving

In the last ten trading sessions on Comex, 62 tonnes of gold have been stood for delivery, and 1,303 tonnes of silver. What does this tell us?

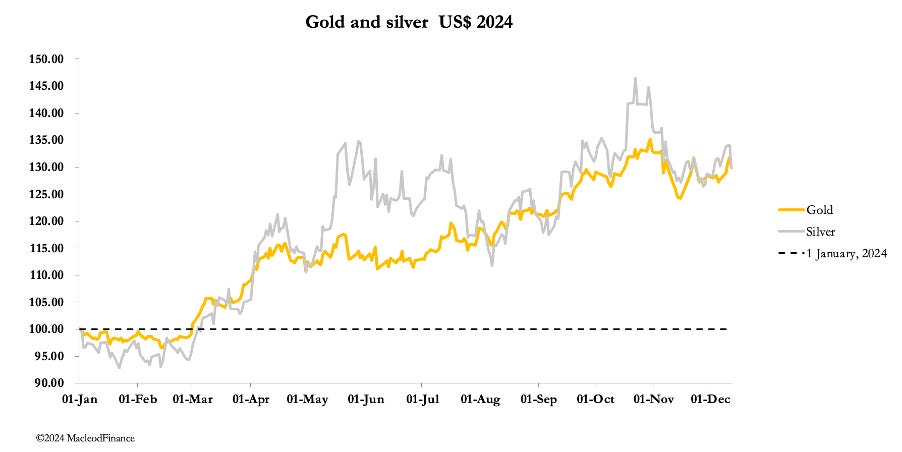

It was a week of two halves for gold and silver prices: rising strongly until Thursday when prices were smashed. In European trading this morning, gold was $2670, up $40 on balance from last Friday’s close having touched $2725 on Thursday morning. And silver was 20 cents lower on balance at $30.80, having been as high as $32.30. Trading volumes in the gold contract were moderate, but more active in silver.

A feature of this week’s trading was levitated futures’ premiums over spot, particularly noticeable in silver which before yesterday’s price smash represented a premium over overnight rates of as much as 7% annualised for the active February contract. While premiums and discounts in futures contracts over spot can and do vary, this detachment was unusually high. This sense of panic has now abated, and bullish hedge fund speculators are being stopped out.