Inflation will be the big surprise in 2026—2027

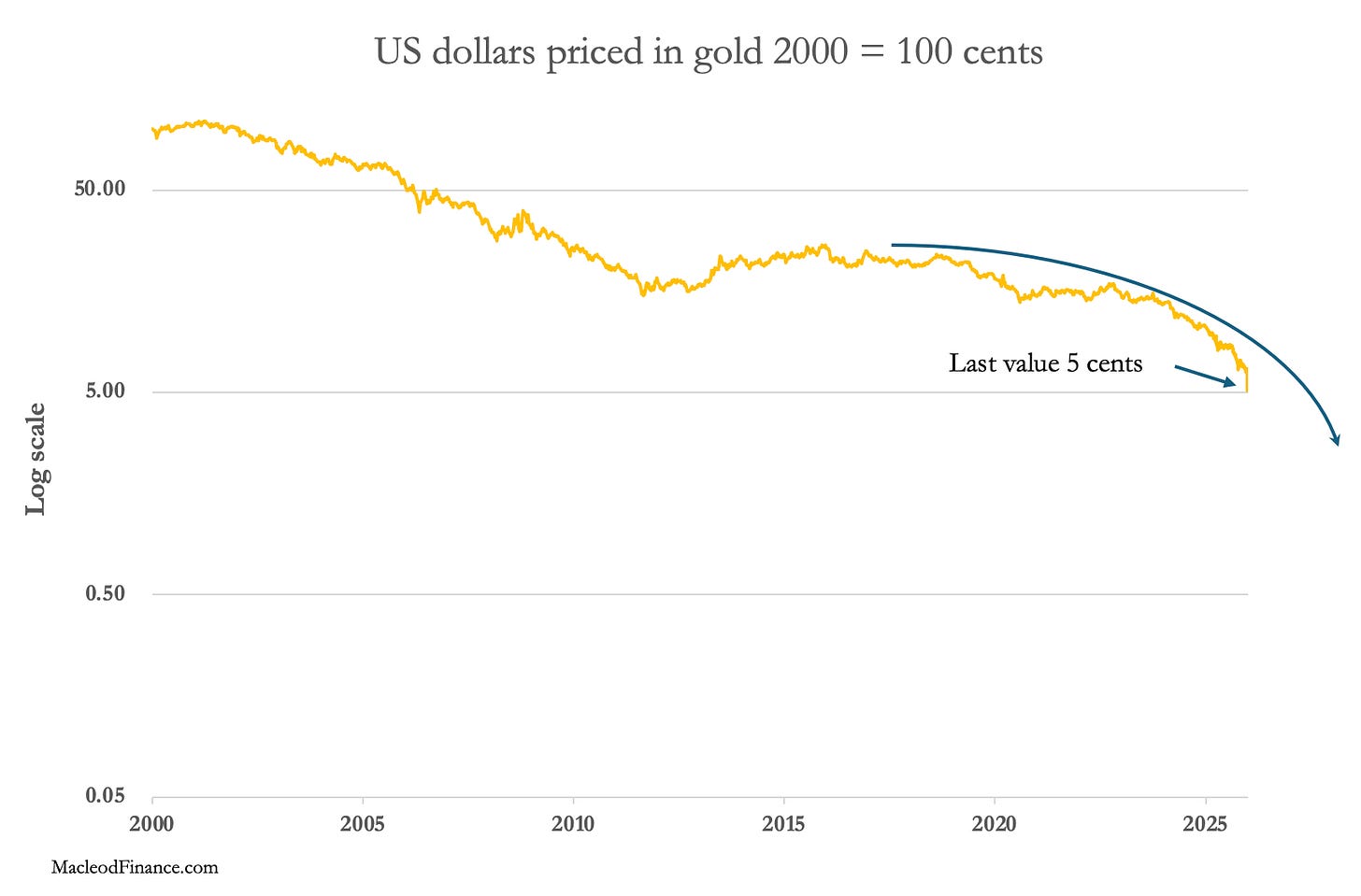

Gold confirms our thesis, that the purchasing power of the dollar faces a collapse. More conventionally, this will be reported as soaring price inflation and almost no one expects it.

Do not be surprised to see consumer price inflation rise strongly later this year. And we are not talking just 5 or 10 percent. It will be far higher, driven by the US Government’s attempts to avoid a financial crisis from rising bond yields, shore up the stock market, and rescue the financial system.

It will reflect a collapse in the dollar, which is set to accelerate rapidly as it approaches the end of its life as a fiat currency.

We have had a fiat dollar for so long now, that very few people understand that it is only credit whose value depends partly on changes in its quantity, but most importantly the faith its holders and users have in it. But in both common law and accounting, a paper currency’s value depends entirely on the holder’s faith in the issuer’s obligation to discharge its debt in gold.

The US Treasury reneged on this obligation in 1933 when US citizens were ordered by President Roosevelt to hand in their gold for currency. America’s long default started from that action. Within months the following year he then devalued the dollar by 40% against the gold which citizens were still not allowed to possess. And in 1944, the Bretton Woods Agreement further limited the right to encash dollars for gold to sovereign nations. US citizens were still denied their right to exchange dollars for real money. Even that was abandoned in August 1971 and for over 54 years no one, not even foreign governments, has had the right to cash in dollars for gold.

In effect, a currency which is meant to represent an obligation to pay in gold is effectively worthless. It is a national default. The only reason dollars retain any value