Gold hits records and silver stirs.

Behind precious metal markets is new evidence of growing European investor demand at the retail level, while Comex deliveries continue at an elevated rate.

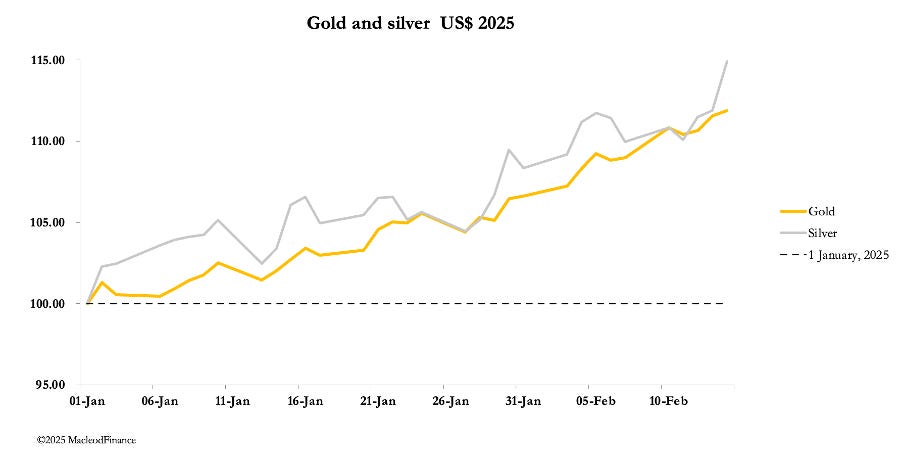

It has been a week of new highs for gold, and silver appears to have broken out of its torpor only this morning. In European morning trade, gold was $2938, up $98 from last Friday, and silver was $33.30, up $1.55 with most of the rise occurring today. The jump in silver is attributed by analysts to strong Chinese PV demand, Indian-pledged PV investment of a further trillion rupees by 2030, and Indonesia promising to adds 17 gigawatts of solar energy through state-owned enterprises.

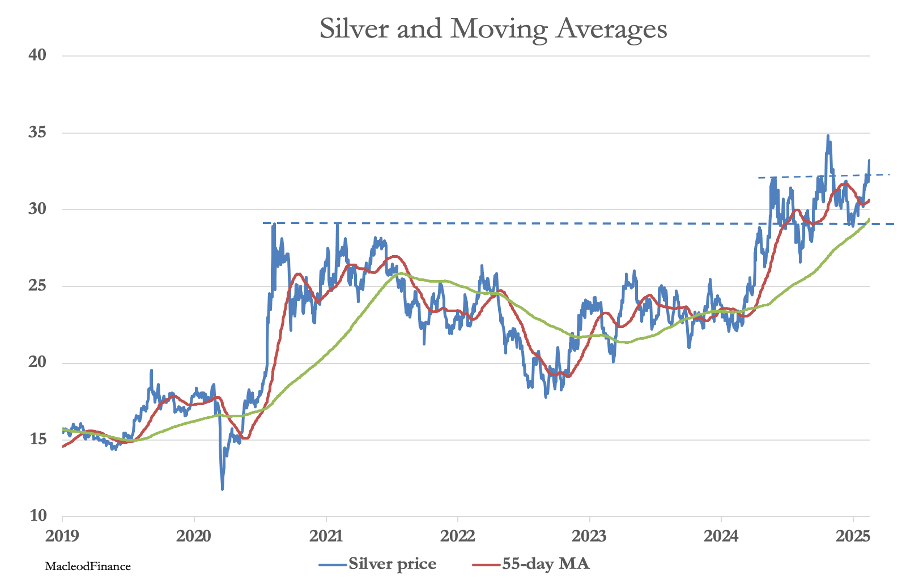

More importantly, silver has conquered a crucial chart level at $32.50:

Not only do we have confirmation that solid support at $29 provides a launchpad for the next up-leg and that the moving averages are bullish, but conquering minor supply at the $32.50 level (the smaller pecked line) has been achieved this morning. The next supply level to overcome is at $35 then $40 is in sight — probably quite quickly.

Gold’s chart is a classic bull market demonstration of an acceleration phase:

Clearly, gold has led the way for silver, playing a large part in ending silver’s slumbers. It has impressive momentum, capable of taking it into highly overbought territory — but it’s not nearly there yet. As an indication, Comex open interest is 534,126 contracts on yesterday’s preliminary figures, and the next chart illustrates there’s plenty of room to accomodate more futures buying:

So, what’s driving it all?