Gold and the G7 debt crisis

It’s no coincidence that all G7 nations face a debt crisis and that gold is going higher again, with silver playing catch up. It’s the beginning of the end for the major fiat currencies.

Last Friday, there was great excitement in the goldbug community, because all of a sudden it looked like gold’s four-month consolidation phase is over and it’s about to rise to who knows where. Buying was notable on Comex with open interest in the gold contract increasing sharply by 21,788 contracts representing about 68 paper gold tonnes on Friday’s preliminary figures.

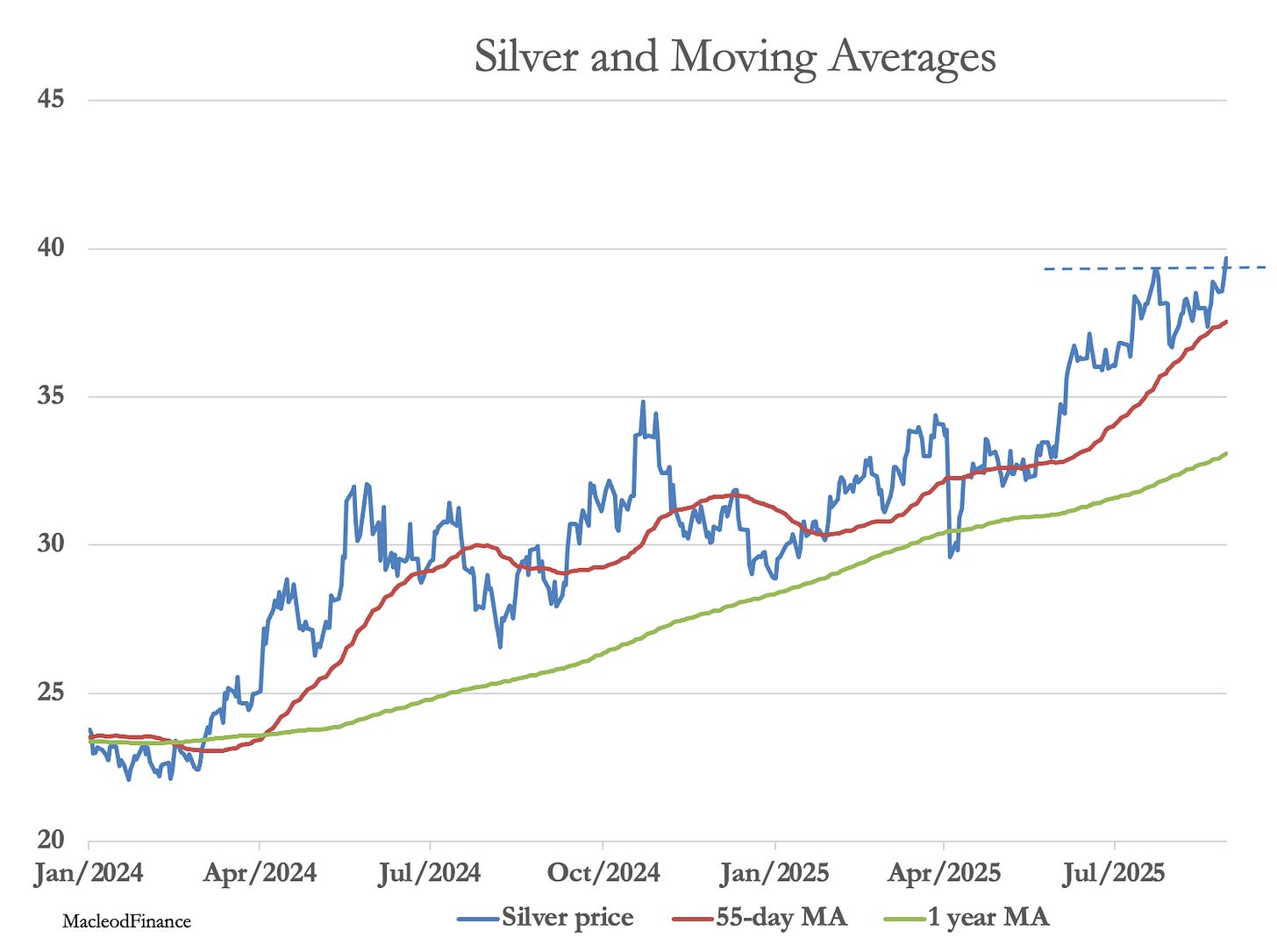

By way of contrast, silver’s open interest fell to the lowest level for three months as a vicious bear squeeze drove the price higher to just under $40 before closing up 1.8% — the highest level in 24 years. Egon von Greyertz of his eponymous gold and silver storage firm confirmed in a King World News interview that finding physical silver for his clients is difficult, confirming its scarce liquidity. And as he put it, investment demand for it has hardly started.

After decades of suppression, without doubt silver is undergoing a massive rerating even against gold. And coincidently with gold’s breakout, after a brief consolidation silver is breaking higher as well:

These advanced warnings of systemic danger are flagging a developing crisis in fiat currencies. In each of the main currency jurisdictions, economic commentators are warning of an impending national crisis without appearing to realise that the other G7s are in the same boat. When it blows, taking the looney down with them the four major G7 currencies will face a collapse in the faith upon which their value relies for similar reasons. The 54-year fiat currency era faces an existential crisis.

This raises the question: when will the crisis be triggered, what form will it take, and how rapidly will it occur?

Essentially, we are looking at escalating credit risk. The most sensitive risk indicator