Gold and silver recovering

In very low turnover on Comex, gold and silver begin to recover as geopolitical tensions rise. Evidence is increasing of a possible attack by the US on Iran in the coming days.

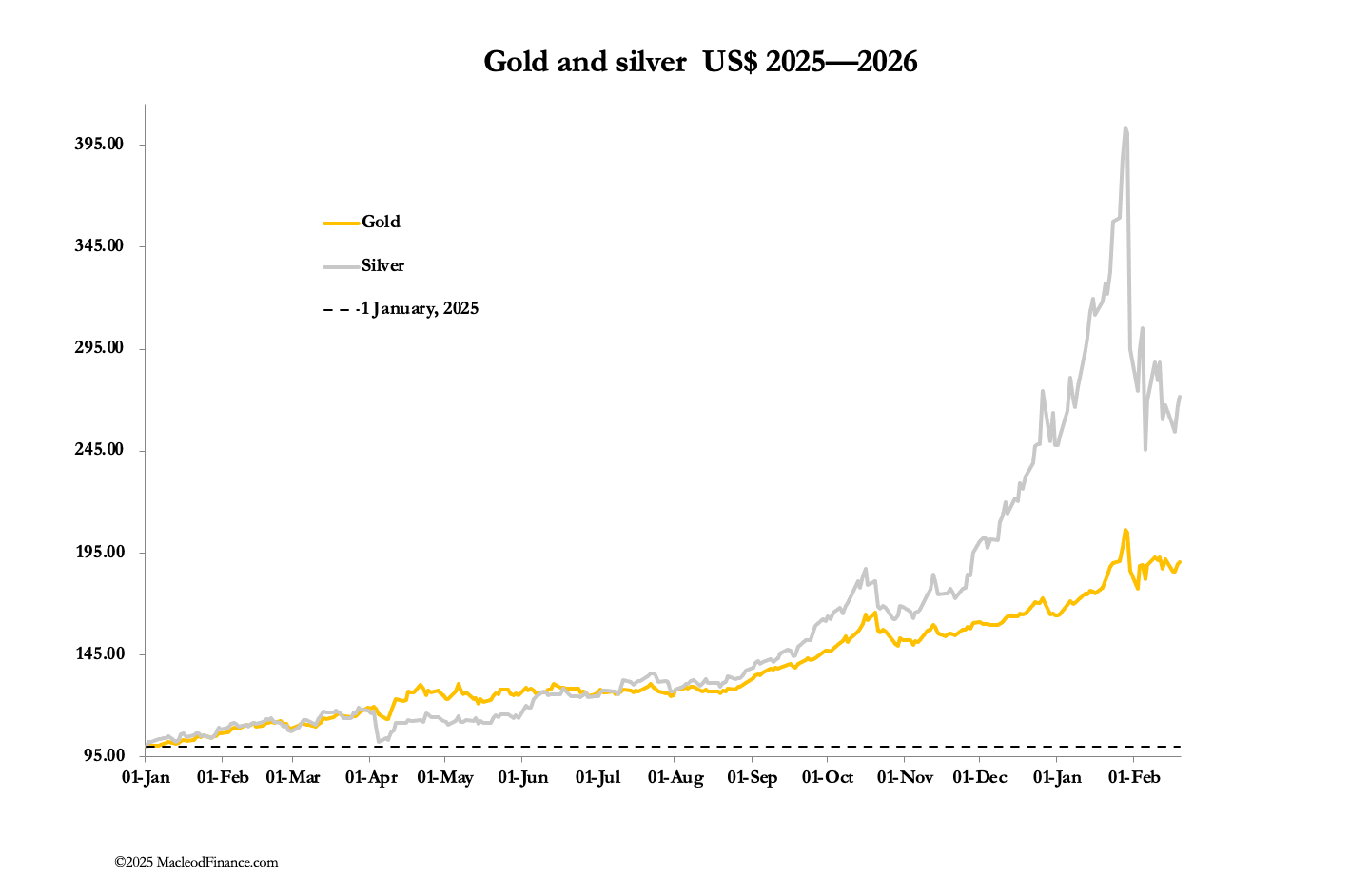

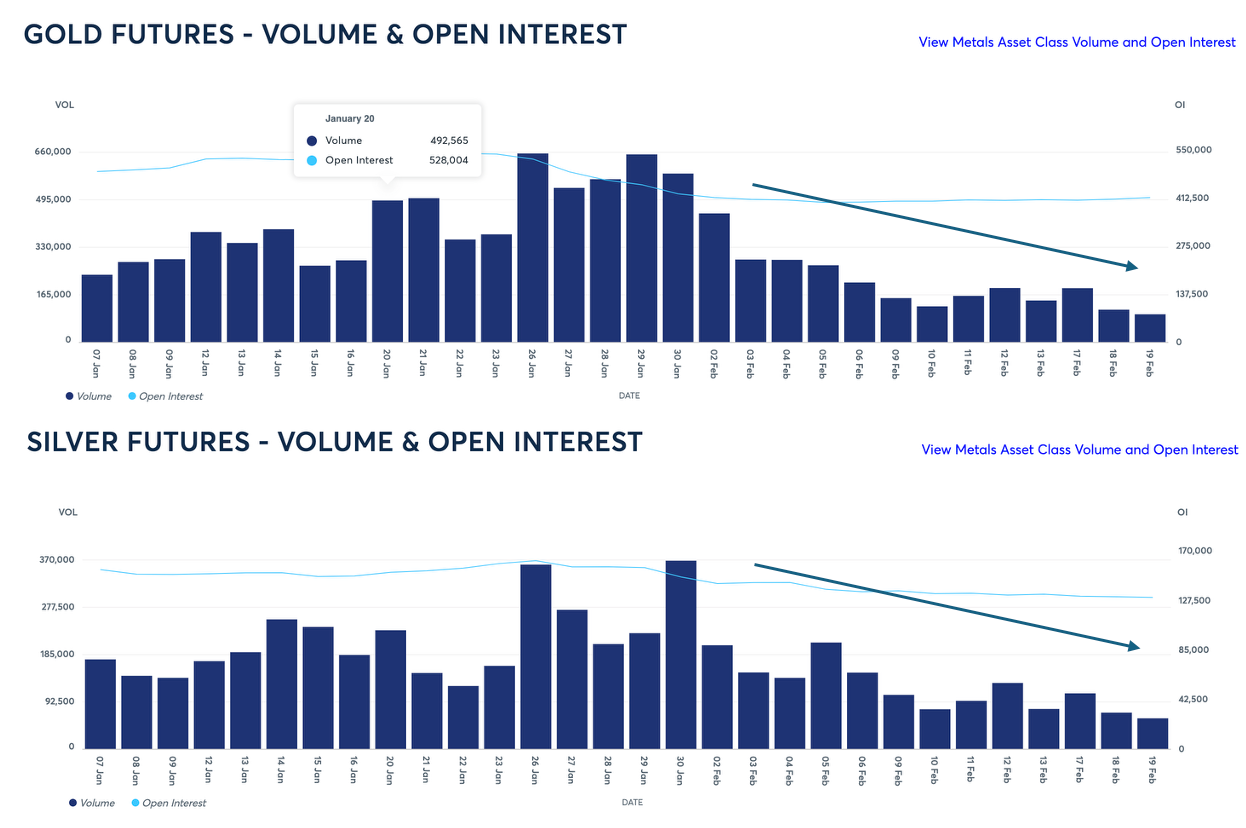

Gold and silver rallied this week in a firmer tone suggesting a gradual climb higher is in prospect. In Europe this morning, gold traded at $5025, up $105 from last Friday’s close, while silver at $80.50 was up $5.30 over the same timeframe. US markets were closed on Monday for Washington’s birthday, which may have contributed to pitifully low volumes on Comex, arrowed on the charts below:

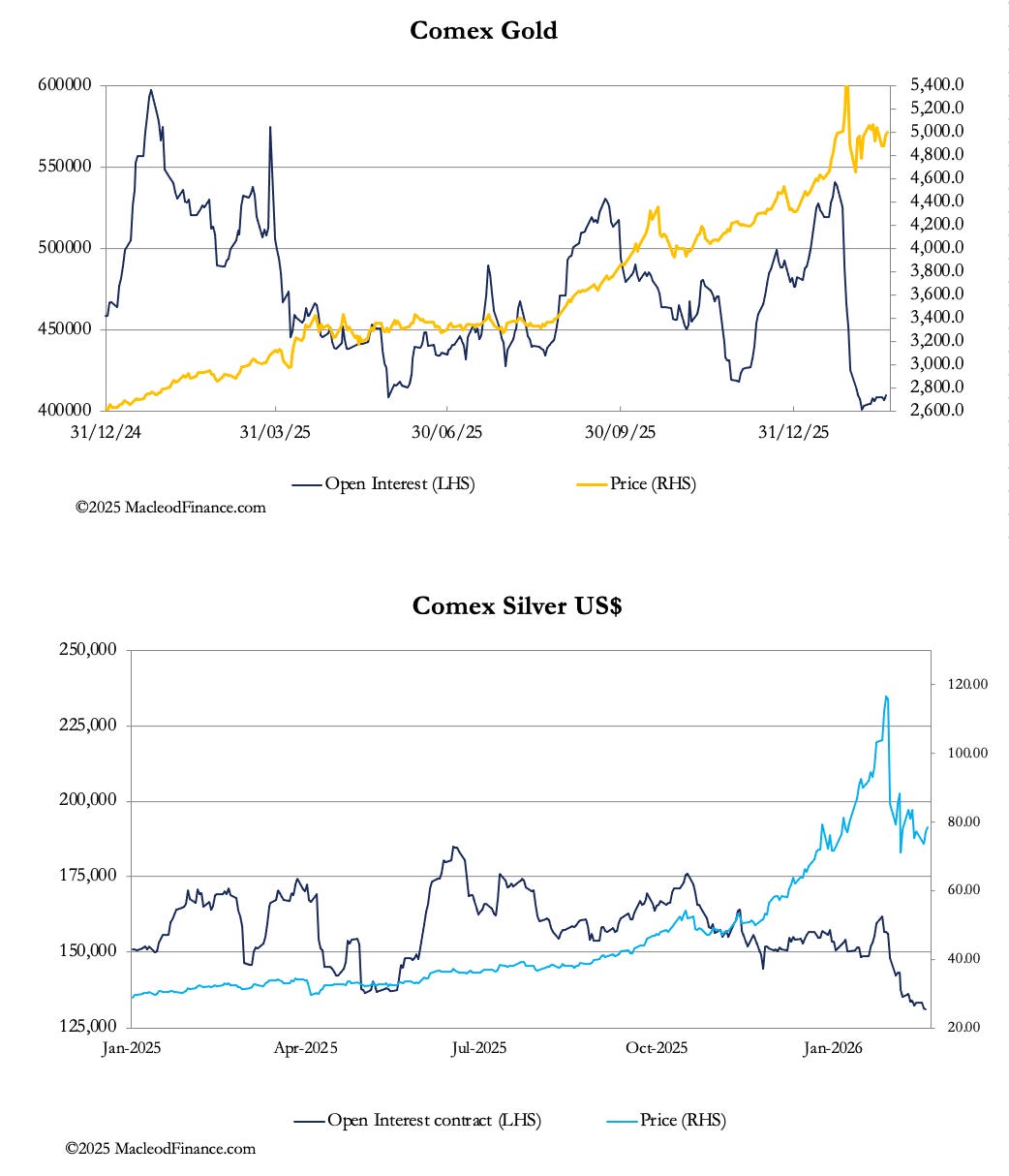

These turnover numbers are exceptionally low, even for holiday periods and reflect a futures market dying on its feet. Open interest in both contracts is also very low, but gold’s is showing some signs of recovery, illustrated next:

Clearly, speculative interest is virtually absent in both contracts, which is likely to be reflected in London’s forward market. If the point behind the recent shakeout was to rinse out flaky longs, then that process is completed.

There has been some uncertainty over price trends during China’s new year holiday, with Shanghai markets being closed for the entire week, reopening on Monday. The evidence is that this is where prices are being determined, particularly for silver with London and New York playing a secondary role. Therefore, the few speculators on the

short side would be sensible to close their bears ahead of the weekend, which explains the feel of a firmer underlying tone for both metals from mid-week onwards.

Additionally, there is mounting speculation by informed sources that the US is preparing to mount an attack on Iran in the next few days. If so, then it could take place this weekend. It follows Bibi’s visit to Washington with his list of demands to be satisfied in current US—Iran negotiations, which are clearly unacceptable to the Iranians.