Gold and silver in sell-off

Strong dollar and rising UST yields are destabilising GBP, EUR, JPY, and their bond markets. These are the precursor of a global debt crisis — the ideal setup for higher gold prices next year.

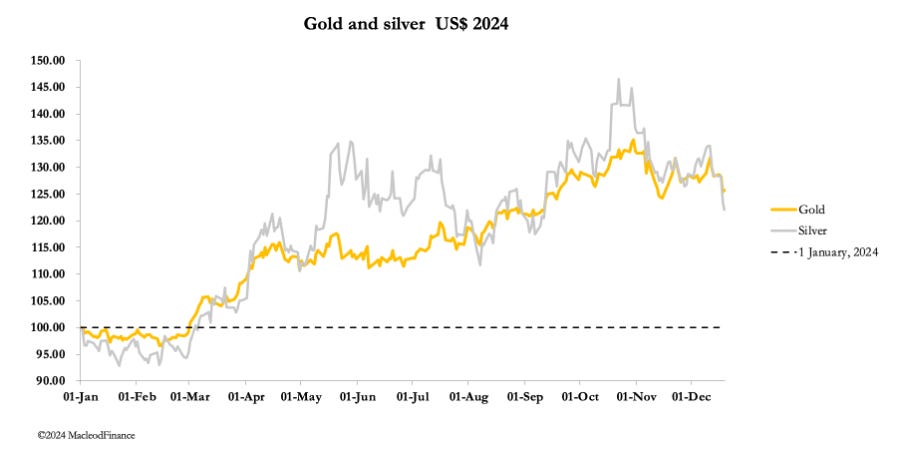

Gold and silver declined further this week, after Jay Powell’s comments having cut the Fed Funds rate by ¼% to 4.25%—4.50% range. In European trade this morning, gold was $2606, down $41 from last Friday’s close, and silver $28.90, down $1.65. Turnover in both Comex contracts was light in the week ahead of Christmas.

All eyes were on the Fed as Powell delivered the expected cut but downplayed the prospects for further interest rate cuts next year. He justified this by saying that he was optimistic about the economic outlook, and the economy is “… in a really good place. I expect another good year next year”.