Gold and silver hit by massive dollar rally

The return of the carry trade is creating a dollar illusion. But rising US Treasury yields are threatening to destabilise the entire global credit system, ultimately for the benefit of physical gold.

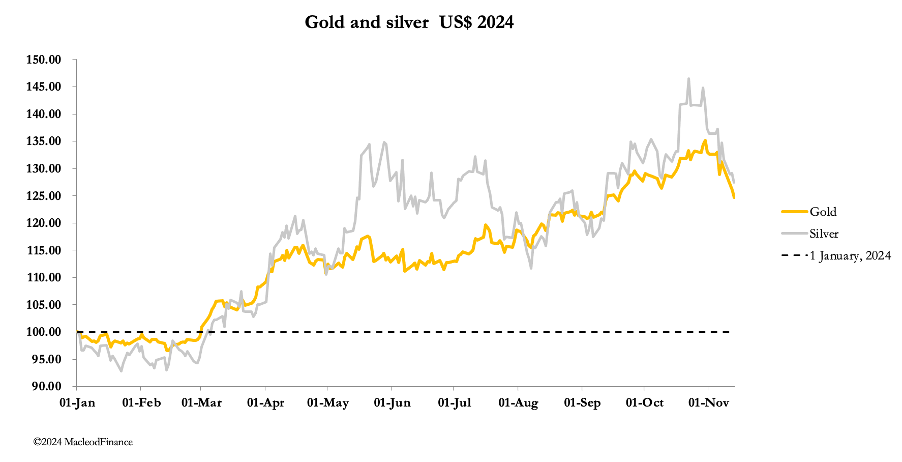

Against a background of a soaring dollar, gold and silver suffered a predictable shakeout. Yesterday (Thursday), gold closed at $2567 after dipping below $2540, for a net fall from last Friday’s close of $121, down $222 from 30 October’s high. Silver closed yesterday at $30.46 after an intraday low at $29.76, down a net 116 cents and off $4.40 from its 22 October high.

The sharpness and rapidity of these falls suggests that a decent technical bounce on bear closing in both gold and silver is in prospect for today. But it would be too early to say with conviction that Thursday’s lows represent the end of their correction.

But where do we go from here?