Debt and gold

It’s 5 years since central banks suppressed interest rates at the zero bound, or even below it. It is the origin of many debt zombies which now face refinancing at far higher rates.

There is little doubt that the suppression of interest rates by central banks ahead of, during, and following covid lockdowns led to an explosion of unproductive debt. Businesses had to finance shutdowns and supply chain disruptions, and governments had to fund support plans and the loss of tax revenue.

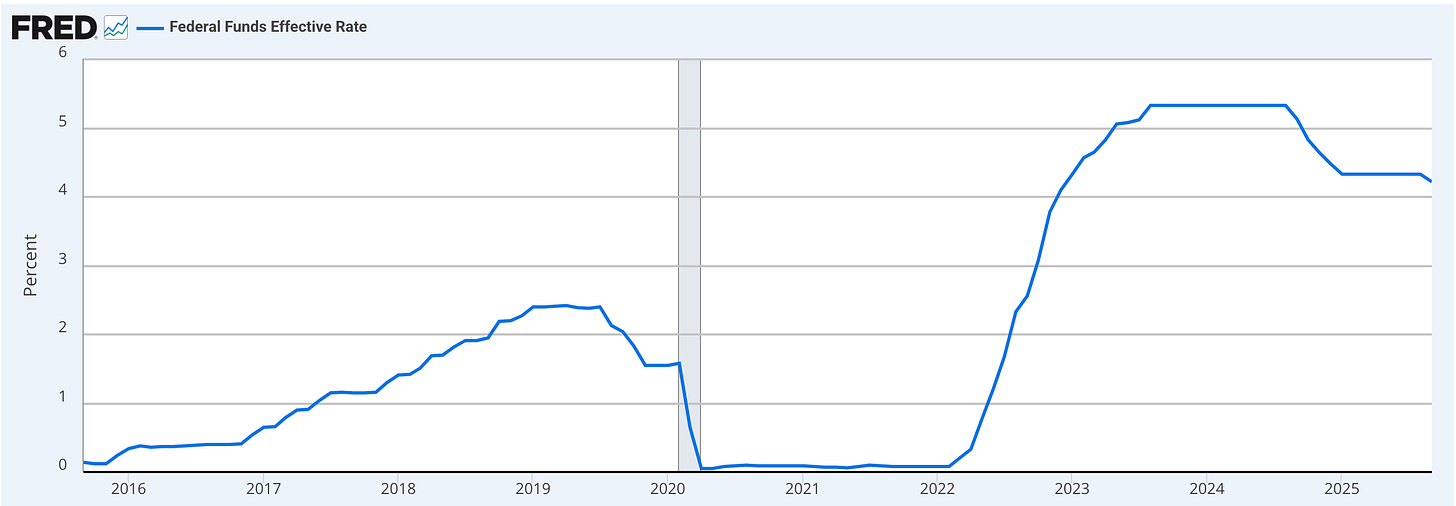

The surprise for many was the consequences for the inflation rate, which led to higher interest rates as central banks struggled to contain it. And it wasn’t until late last year that the interest rate shock softened. Interest rate policies since covid are illustrated in the Fed Funds Rate, below.

What now?

There is little doubt that so long as a 4% Fed Funds Rate exists there will continue to be debt refinancing problems. Pressure on central banks to reduce rates persists, particularly for the Fed and Bank of England. But the spectacular increase in gold