COT gold numbers give little clue

After very heavy turnover on Comex following Trump’s clear win, positions in gold futures give little clue about short-term prospects. But outlook for fiat credit is worse.

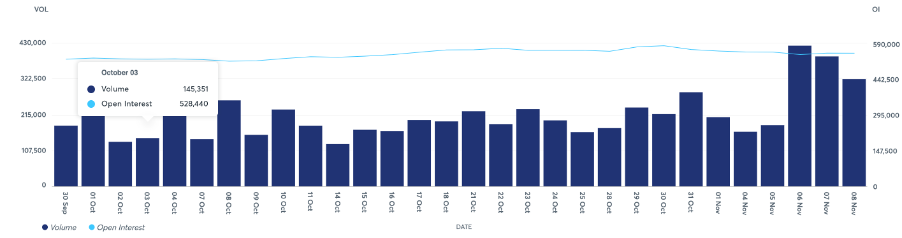

As the thin blue line in the chart above shows, the big fall in the gold price on 6 November doesn’t seem to have rattled the bulls, with Open Interest subsequently declining a little over 5,000 contracts from Tuesday (the last Commitment of Traders figures). I would say, however, that gold selloffs on unexpected news can go deeper than this one, as the post-Lehman experience showed.

Therefore there is little point in speculating over gold price volatility in the coming days. Many a stacker has been tempted to “take profits” at times of price uncertainly, only to find they regret it later when prices rise seemingly beyond their reach. Weak holders get shaken out.