Consolidating amid uncertainty

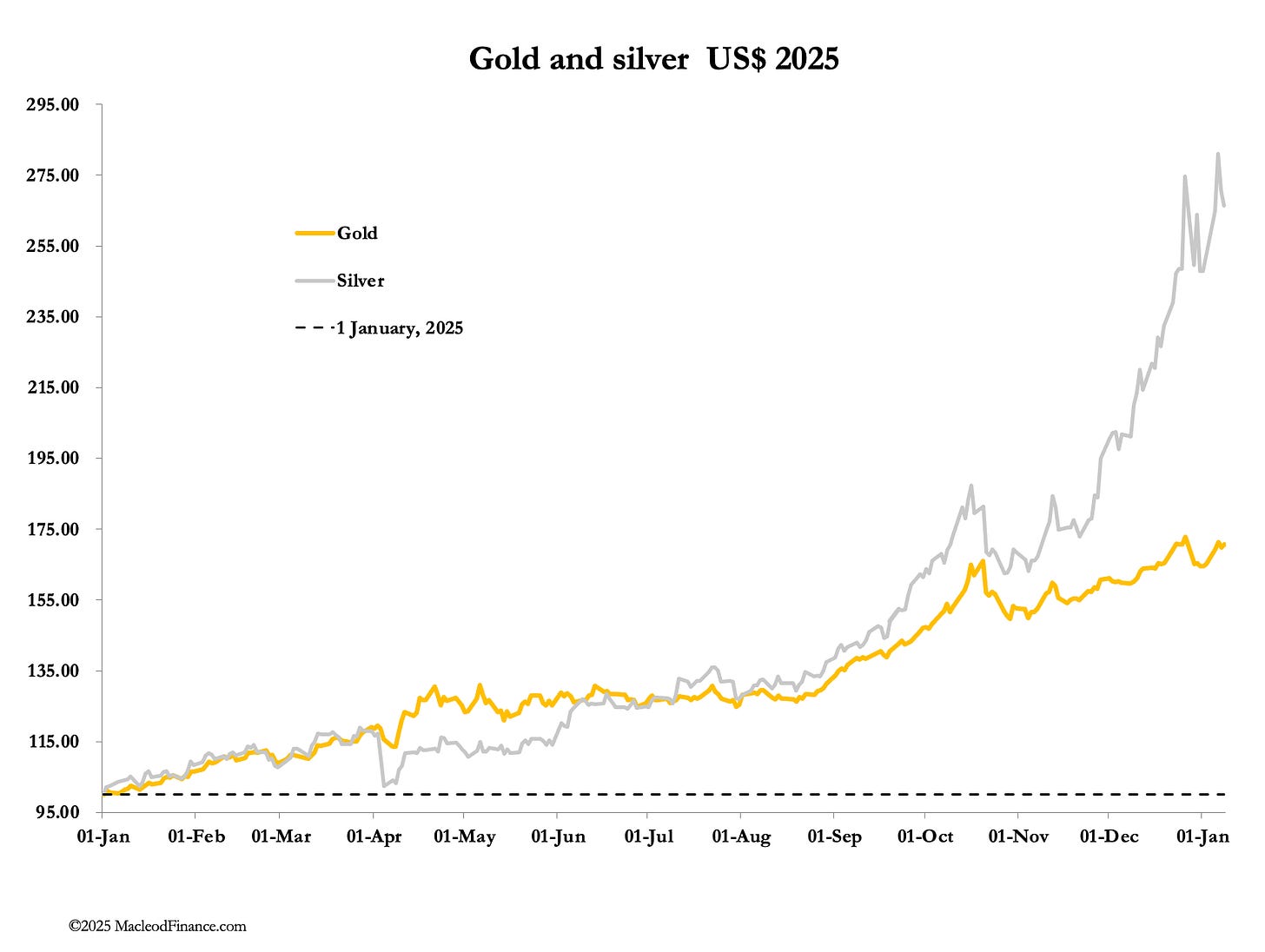

Chinese silver demand is on pause allowing prices to drift from all-time highs. Meanwhile, gold marches on towards a test of its post-Christmas highs.

However, the physical silver shortage is what matters and will continue to drive prices. In gold, there is a dawning realisation that there must be something solid behind its bull market, with speculators returning to Comex. And those clever people behind Tether’s gold stablecoin have been ramping up their reserves buying a further 26 tonnes in 2025 Q4, making them larger holders than most central banks.

Silver’s frenetic rush paused this week with dealers assessing its next move. In European trade this morning it was $77.95, up $4.05 from last Friday’s close, but below Wednesday’s high point of $82.60. At $4471, gold is up $40 on the week, closing in on all-time highs.

Silver prices in Shanghai have held significant premiums over London spot, peaking at almost $90 at one point. This led to strong opening prices in London until Thursday, exacerbating the shortage of physical, until things seem to calm down in Chinese markets overnight. It is worth bearing in mind the Chinese propensity for gambling, which is bound to lead to some wild trading conditions.

Meanwhile, on Comex speculators both in the US and using the Globex facility have stayed out of it. The next chart confirms that the low level of speculator interest remains, despite silver’s dramatically bullish run: