Asian buying returns

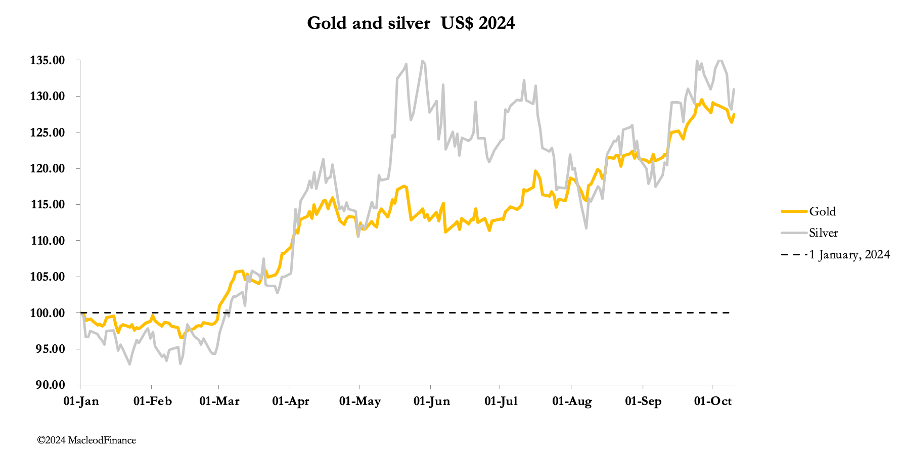

Gold and silver are now nicely set up for higher prices in the runup to the BRICS summit in eleven days’ time. But after that, will there be profit-taking and a pull-back consolidation?

After a sell-off on Wednesday completing a 10-day consolidation, spot gold saw a resumption of overnight (Asian) demand last night, to trade at $2641 in early morning European trade, down only $11 on the week. After peaking at $32.96 intraday last Friday, spot silver sold off down to $30.14 before recovering to $31.15 this morning, for a net loss of $1.00 on the week.

The temporary absence of Chinese demand coincided with the Golden Week holiday, with dealers returning on 8 October. It gave market-makers and bullion bank traders an opportunity to shake out speculative longs in western derivative markets. But Comex saw gold’s Open Interest decline by a paltry 11,000 contracts, before buyers stepped in buying all their positions back in only two sessions.

In silver, Open Interest fell by 4,200 contracts before recovering only 422 of them on preliminary figures yesterday. Despite all the volatility from the start of Golden Week, the price is unchanged, a remarkable demonstration of the failure of the bullion establishment to reduce their short positions. The charts below, of Open Interest and price for gold and silver are worth more than a cursory glance.